The Facts About Commercial Insurance In Dallas Tx Uncovered

Wiki Article

Life Insurance In Dallas Tx Fundamentals Explained

Table of ContentsNot known Facts About Insurance Agency In Dallas TxHow Commercial Insurance In Dallas Tx can Save You Time, Stress, and Money.7 Easy Facts About Health Insurance In Dallas Tx ShownRumored Buzz on Insurance Agency In Dallas TxInsurance Agency In Dallas Tx for BeginnersExcitement About Home Insurance In Dallas Tx

As well as because this insurance coverage lasts for your whole life, it can aid sustain long-term dependents such as kids with disabilities. Disadvantage: Cost & intricacy a whole life insurance policy can be significantly a lot more costly than a term life plan for the exact same death advantage quantity. The money value component makes whole life extra complicated than term life due to charges, tax obligations, passion, and various other terms.

Cyclists: They're optional attachments you can make use of to tailor your plan. Some plans include cyclists automatically included, while others can be included at an additional expense. Term life insurance coverage plans are generally the finest option for individuals that need economical life insurance policy for a particular period in their life.

Examine This Report on Home Insurance In Dallas Tx

" It's constantly advised you talk to a qualified agent to establish the finest solution for you." Collapse table Now that you recognize with the essentials, below are added life insurance policy plan kinds. Many of these life insurance choices are subtypes of those included above, implied to offer a certain objective.Pro: Time-saving no-medical-exam life insurance gives much faster access to life insurance policy without having to take the medical exam., also known as volunteer or voluntary supplemental life insurance, can be used to connect the insurance coverage gap left by an employer-paid group plan.

Unlike various other plan kinds, MPI just pays the survivor benefit to your home loan loan provider, making it a a lot more minimal alternative than a conventional life insurance coverage policy. With an MPI policy, the beneficiary is the home mortgage company or loan provider, instead of your family members, and also the survivor benefit lowers with time as you make home loan settlements, similar to a reducing term life insurance coverage plan.

The Basic Principles Of Home Insurance In Dallas Tx

Since AD&D only pays out under certain conditions, it's not an ideal alternative for life insurance policy. AD&D insurance only pays out if blog here you're injured or killed in a mishap, whereas life insurance policy pays for many reasons of death. As a result of this, AD&D isn't suitable for everybody, however it may be valuable if you have a high-risk line of work.

Rumored Buzz on Life Insurance In Dallas Tx

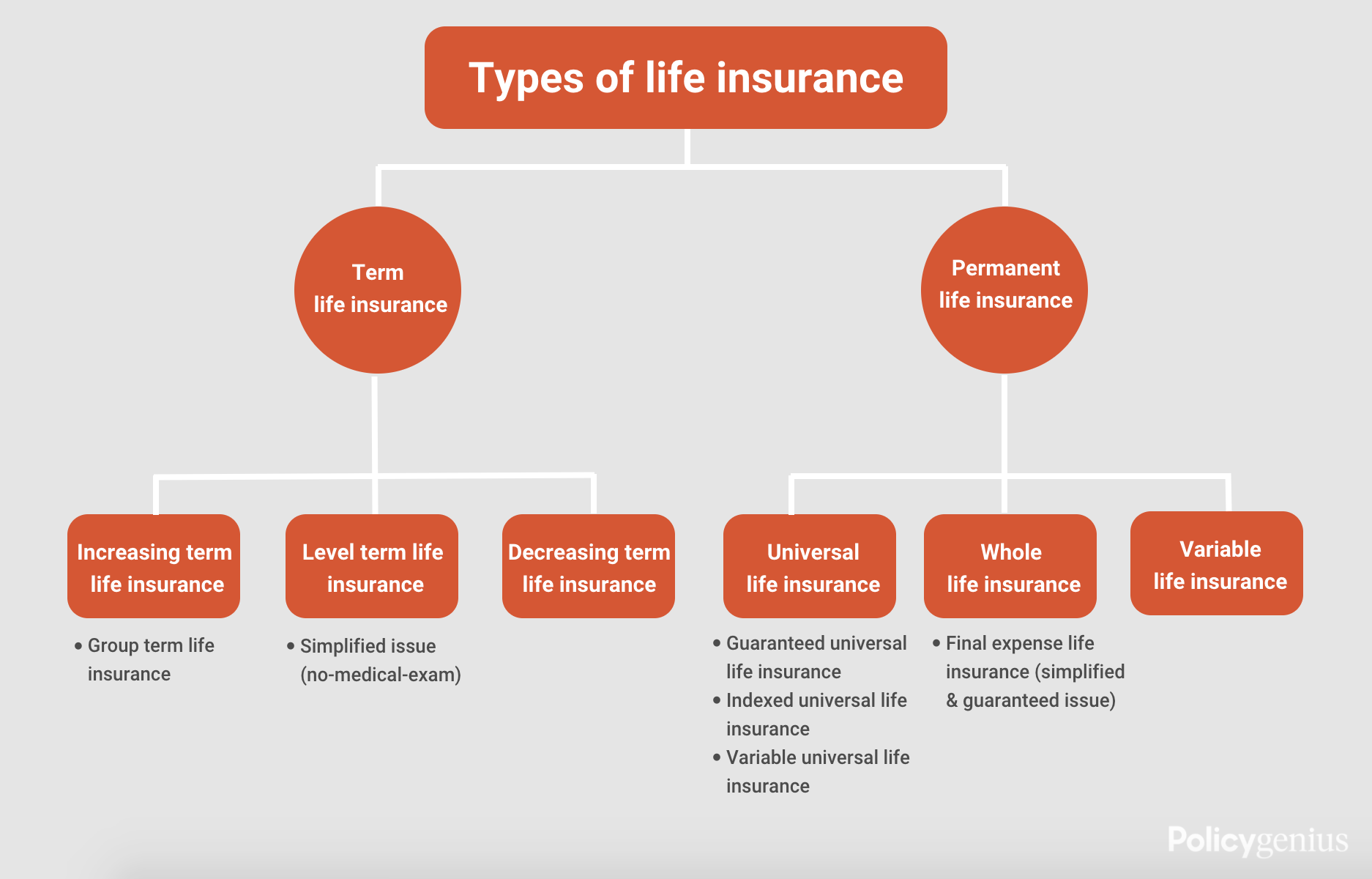

Best for: Couples that don't receive two private life insurance policy plans, There are 2 major kinds of joint life insurance policy policies: First-to-die: The policy pays after the first of both partners passes away. First-to-die is one of the most comparable to a specific life insurance coverage plan. It helps the surviving policyholder cover expenses after the loss of financial backing.What are the 2 major types of life insurance? Term and long-term are the 2 primary types of life insurance policy.

Both its period as well as cash worth make long-term life insurance coverage lots of times more expensive than term. Term life insurance policy this content is normally the most inexpensive and extensive type of life insurance policy since it's simple as well as offers economic security during your income-earning years.

The 7-Minute Rule for Insurance Agency In Dallas Tx

Whole, global, indexed universal, variable, as well as interment insurance are all kinds of permanent life insurance policy. Irreversible life insurance policy usually features a money worth and has greater costs. What is the most typical kind of life insurance? Term life as well as entire life are the most prominent kinds of life insurance policy.life insurance policy market in 2022, according to LIMRA, the life insurance coverage research study company. Meanwhile, term life premiums stood for 19% of the market share in the same period (bearing in mind that term life costs are more affordable than whole my website life costs).

There are 4 fundamental parts to an insurance policy agreement: Affirmation Web page, Insuring Agreement, Exemptions, Problems, It is necessary to understand that multi-peril policies might have details exclusions and also problems for every type of insurance coverage, such as accident protection, medical repayment insurance coverage, responsibility insurance coverage, and so on. You will require to ensure that you check out the language for the specific insurance coverage that uses to your loss.

Some Ideas on Truck Insurance In Dallas Tx You Need To Know

g. $25,000, $50,000, and so on). This is a recap of the major guarantees of the insurer as well as specifies what is covered. In the Insuring Arrangement, the insurance firm concurs to do specific points such as paying losses for covered dangers, offering specific services, or accepting safeguard the insured in a responsibility lawsuit.Instances of left out home under a property owners policy are individual residential property such as a car, a pet dog, or an aircraft. Conditions are provisions put in the plan that qualify or place restrictions on the insurance provider's promise to pay or do. If the plan problems are not fulfilled, the insurance firm can deny the case.

Report this wiki page